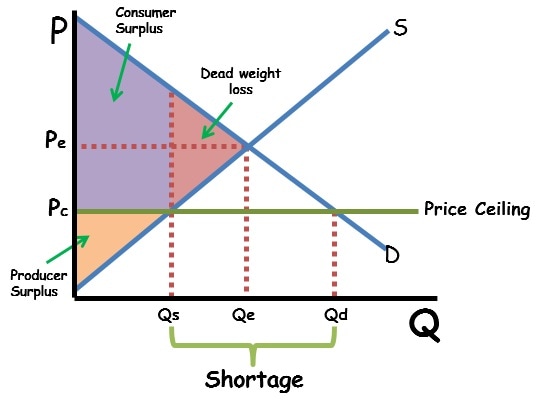

If the equilibrium price is $6 and the government says you cannot charge more than $8, the government intervention is meaningless or ‘non-binding’. (Credit: Manoel Lemos/ Flickr/ CC BY-SA 2.0) Save Us R2-D2, You’re Our Only Hope! This means that 200 renters who want to rent can no longer find homes! This is important, because when quantity demanded and quantity supplied are unequal, the market is restrained by the lower value.ĭespite this information, it is not enough to tell us if the market is more or less efficient – our metric for that is market surplus. Even though some renters cannot find homes, the government still successfully lowered the price for some consumers. At the lower price of $400/month, quantity supplied is only 200 housing units and a quantity demanded is 400 housing units. Whereas before 300 homes were rented, there is now a housing shortage.

What will this do to our equilibrium? Refer to Figure 4.5a. This policy means the landlords cannot charge more than $400 per month. If the government wishes to decrease this price to make it more affordable for renters, it may place a binding price ceiling of $400/month. Consider a rental market with an equilibrium of $600/month. But what if the government regulates the market so that it cannot move? Price Ceiling Figure 4.5aĪ common example of a price ceiling is the rental market. In Topic 3, we examined what will occur if price is below or above equilibrium price, and concluded that market pressures will return the market to equilibrium. The first government policy we will explore is price controls. Understand why price controls result in deadweight loss.Explain price controls, price ceilings, and price floors.By the end of this section, you will be able to:

0 kommentar(er)

0 kommentar(er)